The clearing house automated payments system chaps is a u k based system that facilitates large british pound denominated money transfers.

Clearing house automated payment system advantages and disadvantages.

Strict cut off times e g.

Chaps is typically used for high value urgent payments such as those transferred by a solicitor between banks and current accounts during a house purchase.

The automated clearing house ach is the primary system that agencies use for electronic funds transfer eft with ach funds are electronically deposited in financial institutions and payments are made online.

Payments take three days to clear vs instant faster payments.

Automated clearing house ach payments are electronic payments that pull funds directly from your checking account.

Bank to bank payments can also be made through faster payments.

Instead of writing out a paper check or initiating a debit or credit card transaction the money moves automatically.

Advantages of a clearing house automated payment systems chaps.

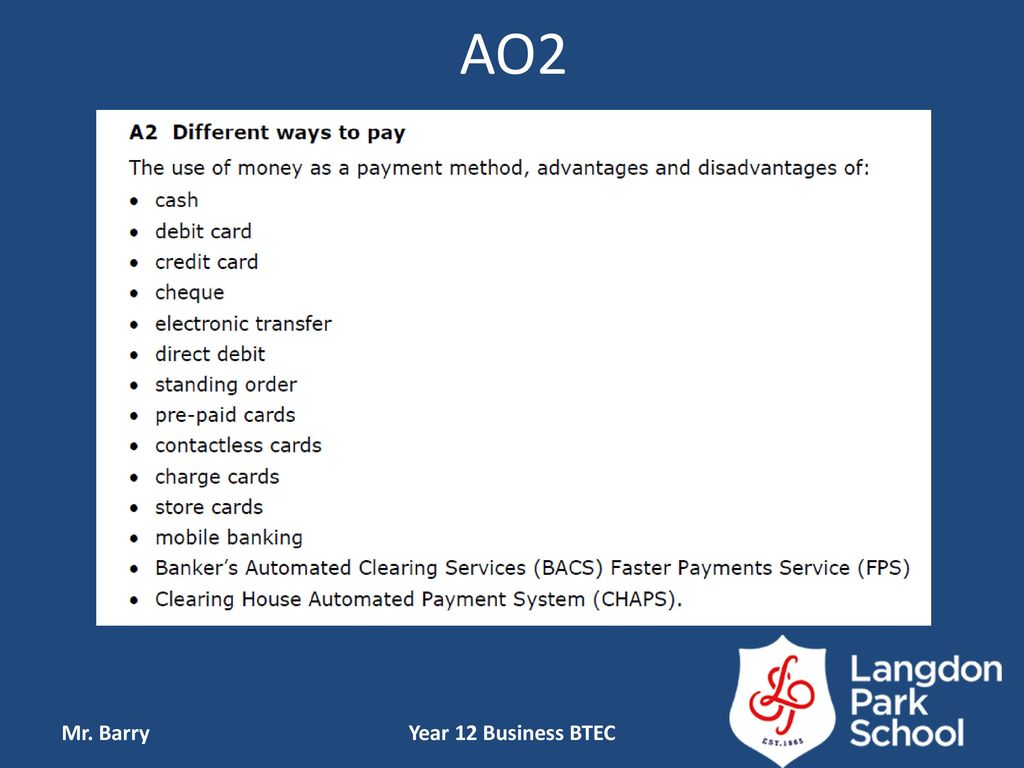

They re all used for different types of payments and come with their own advantages and disadvantages.

Here are some of the special features of each payment type.

Advantages and disadvantages of chaps.

Minimize paper records that carry sensitive banking information.

Cross remittances follow up for credit collection and delays are eliminated.

Get paid faster with an automated payment and without waiting for a check to clear.

Automating bill payments to avoid late fees and missed payments.

Disadvantages of a clearing house automated payment systems chaps normally there is a fixed charge per.

Wednesday 3pm to have payments sent on friday alternatives to bacs payments.

With the help of bacs payment schemes limited formerly known as bankers automated clearing services businesses now have a smarter safer way to manage their multiple financial transactions.

Chaps payments are used for retail and wholesale high value payments within.

Members associates receive full accounting and reconciliation statements.

The clearing house automated payment system chaps has been in operation since 1984.

The clearing house automated payment system chaps is a way of transferring sums of money the same day.

Bacs payments only clear on business days.

Multinational banks principally use chaps.

The days of issuing paper cheques and managing payroll systems manually have come and gone.

2 pm at barclays there is no limit on the amount that can be transferred in a single transaction.

Through a single net receipt from the clearing house or payment to the clearing house each month members associates settle their accounts with all other participants.

Making online purchases without having to use a credit card or check.

:max_bytes(150000):strip_icc()/abstract-mirror-building-texture-1027237872-b14c58eec89f4416b003f752eea26335.jpg)

:max_bytes(150000):strip_icc()/GettyImages-183296243-a79f62baef094d728d7aee8539fb5778.jpg)